With the advent of commercially available artificial intelligence (AI) systems, the need for incredible computing power is increasing. Newcomer CoreWeave (CRWV) -6.95%))the first public recruitment was held on March 28th, and we stepped up to meet that need.

The company offers cutting-edge cloud infrastructure designed to support AI systems. To do this, coreweave relies on the technology provided by nvidia (NVDA) -0.42%)). Nvidia’s graphics processing units (GPUs) and other AI products are positioned to power the next wave of innovation.

As Nvidia CEO Jensen Huang said, “We are entering a new industrial age, defined by our ability to generate intelligence at scale.” Against this background, which stocks offer better long-term investment opportunities from here: CoreWeave or Nvidia?

Image source: Getty Images.

The rise of Nvidia and the AI factory

The new industrial age described by Jensen Huang will require AI factories. This is a specialized data center equipped with cutting-edge hardware designed to support the computing power demands of AI systems.

This is why organizations looking to lead the AI space are building new data centers. For example, Meta Platform is building a platform in Louisiana, with CEO Mark Zuckerberg saying it is “very big and covers a significant portion of Manhattan.” Oracle is working on a data center, so it will require three small modular reactors to run it.

As a major hardware provider (particularly GPUs), Nvidia will benefit from the construction and operation of these AI plants. The sale of chips using the latest GPU architecture, Blackwell, remains strong, and the company is already preparing to release Blackwell’s successor next year, the Vera Rubin Architecture.

Its ability to steadily advance its technology has driven Nvidia’s sales to historic highs. In fiscal year 2025 (ends January 26th), revenues rose 114% to a record $1300.5 billion.

In fiscal 2026, first quarter revenue was $44.1 billion, up 69% from the previous year, and operating profit rose 28% to $21.6 billion. Nvidia forecasts continuous revenue growth for the second quarter, with revenues of $45 billion to $30 billion for the previous year’s period.

This growth comes despite US government restrictions on what could sell AI hardware to customers there, which led to a decline in NVIDIA’s sales to China. In hopes of rekindling its operations in China, Nvidia is working on acceptable chips to export there under new regulations. This new chip could be released in the fall.

Check out CoreWeave

The need for AI factories is to give a serious boost to CoreWeave’s business. The demand for computing power, such as Meta, ChatGpt owners Openai and Microsoft, is extremely high, and it uses CoreWeave’s cloud infrastructure to complement its own data centers. This brought CoreWeave Drive to $981.6 million in the first quarter, a staggering 420% increase from the previous year.

Despite the uncertainty about how companies will adjust IT spending in light of President Donald Trump’s ever-changing tariff policy, the company sees its client demand as its unsuccessful. CoreWeave Management is leading sales to accelerate from $395 million the previous year to $1.1 billion in the second quarter.

CoreWeave also announced this month that it will acquire digital asset mining company Core Scientific. Before the AI revolution began, CoreWeave was also involved in cryptocurrency mining. However, the acquisition is not a return to its roots.

Instead, CoreWeave can use Core Scientific’s IT infrastructure to increase capacity and increase the number of customers who need AI computing power. It also reduces CoreWeave costs. This is because it reduces CoreWeave costs.

Building cutting-edge computing infrastructures is not cheap, so cost savings are necessary. In the first quarter, CoreWeave caused an operating loss of $27.5 million as its operating expenses swelled from 487% to $1 billion.

Determine CoreWeave and Nvidia stocks

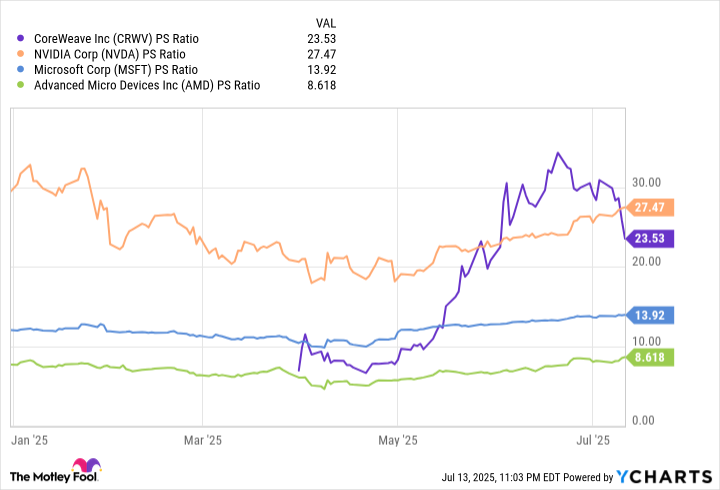

Another important consideration when investing in either CoreWeave or Nvidia is assessment. As only one of them is profitable, the price to sales (P/S) ratio is a useful metric to compare them, and a useful metric to measure them against other AI businesses such as Microsoft and Nvidia’s competitor AMD.

Data by ycharts.

The P/S ratio of both companies has risen in recent months, far surpassing Microsoft and AMD. This suggests that both stocks are expensive, even if CoreWeave’s P/S penetrated in July.

As a result, I think it’s better to wait for the stock to trade at a more reasonable valuation before picking up any stock. However, if that opportunity arises, the company you choose is nvidia.

The reason we choose Nvidia at CoreWeave is because the former is a key player in the growth of the AI industry, continuously improving its technology and has a wide range of competitive moats. In contrast, CoreWeave’s business model can be replicated by many competitors, and some customers may discontinue using company services once they have built their own sufficient data centers.

As a result, Nvidia looks like a great long-term investment between these two AI businesses.

Randi Zuckerberg, a former director of market development, Facebook spokeswoman and sister to Metaplatform CEO Mark Zuckerberg, is a member of Motley Fool’s board of directors. Robert Izquierdo has advanced microdevice, metaplatforms, Microsoft, Nvidia, and Oracle positions. Motley Fools introduces and recommends advanced microdevice, meta platforms, Microsoft, Nvidia, and Oracle. Motley Fool recommends the following options: A $395 phone at Microsoft for January 2026 length and a $405 phone to Microsoft for January 2026 short term. Motley Fools have a disclosure policy.