C3.ai (AI) stock rose after a positive earnings report and guidance update. But it wasn’t enough to change my opinion of this company, which specializes in providing model-driven architectures for enterprise artificial intelligence applications. This loss-making company simply has an unsustainable valuation, faces competition from peers, and I don’t find its growth trajectory all that appealing. This is why I’m bearish.

Maximize your portfolio by choosing the best stocks.

Use Analyst Top Stocks to discover the top-rated stocks by highly ranked analysts. Easily identify top-performing stocks and invest smarter with Top Smart Score Stocks.

C3.ai is not growing fast enough

One of the reasons I’m bearish on C3.ai is its valuation and growth trajectory. While C3.ai’s recent financial results, released on Dec. 9, show some promise, the company’s broader growth trajectory raises concerns when compared to the burgeoning AI market as a whole.

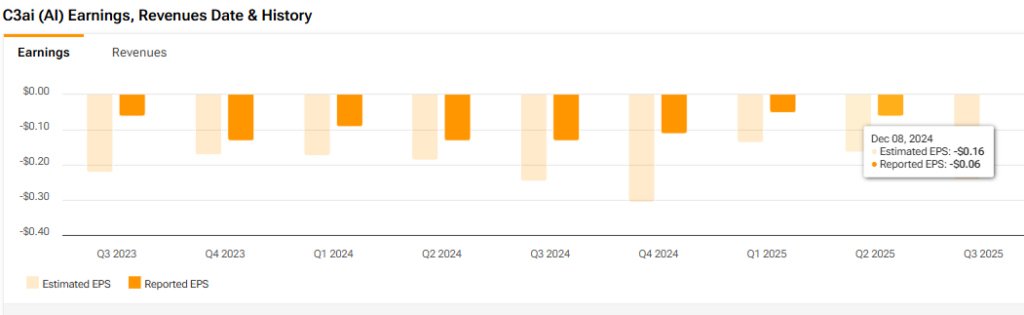

In the second quarter of 2025, the company posted revenue of $94.3 million, up 29% year-over-year, and issued optimistic guidance revisions projecting 2025 revenue of $378 million to $398 million. I did. However, C3.ai is still in the red, and while these numbers are strong, they don’t light the world in this fast-moving market.

The global AI market is projected to grow from 8 billion in 2024 to nearly .68 trillion by 2034, reflecting a compound annual growth rate (CAGR) of 19.1%. In contrast, C3.ai’s revenue growth, while positive, lags many of its peers and does not justify its valuation. More on this later. Companies like OpenAI and Google (GOOGL) are leveraging advances in AI at a much faster pace, significantly increasing their market share and valuation.

As highlighted, C3.ai remains in the red with an adjusted net loss of $0.06 per share in the quarter despite benefiting from strategic alliances such as its partnership with Microsoft (MSFT) , highlighting ongoing profitability challenges.

Concerns about C3.ai’s business

I’m also bearish because of broader concerns about the company’s revenue, customer acquisition, and business model. C3.ai has moved from a subscription-based model to a consumption-based pricing model. In the short term, this may reduce visibility regarding the company’s long-term prospects. Although this model shortened the sales cycle from 5 months to 3.7 months and lowered the entry point for customers, it does not justify the valuation.

Additionally, customer acquisition remains a significant cost and challenge for C3.ai. In the third quarter of 2024, sales and marketing expenses increased 27.6%, outpacing revenue growth of 17.5%. This unsustainable trend suggests that the company is spending too much on customer acquisition, sometimes at the expense of profitability.

Additionally, C3.ai’s long-term revenue growth rate of 18.5% CAGR is lower than the overall GenAI market’s projected CAGR of 76%. This is not a good sign, and this discrepancy indicates that the company may be struggling to take advantage of the rapid expansion of the AI industry despite strategic partnerships and diverse product offerings. There is.

AI is crowded and C3.ai is a small player

If I were an investor in C3.ai, the AI market is becoming increasingly competitive, with tech giants like Google, Microsoft, and Oracle (ORCL) investing heavily in causal AI and enterprise solutions. would be concerned about that. These peers have much deeper deep pockets and established customer bases than C3.ai, making it difficult for C3.ai to gain significant market share. This could even make C3.ai a takeover target.

Despite its focus on enterprise AI solutions, C3.ai remains a relatively small player in this competitive space. Due to limited resources, I suspect it will be difficult for the company to gain significant market share despite promising partnerships with some of the biggest names in the technology space.

CA.ai’s valuation soars

Finally, and perhaps the main reason I’m bearish, is C3.ai’s valuation, which appears significantly inflated compared to its financial performance and peers.

Due to continued losses, the price-to-earnings ratio (PER) is still not applicable, and profitability cannot be expected until at least 2027, when the estimated P/E ratio is 1,595.1 times. Such indicators suggest speculative optimism rather than tangible financial strength. Additionally, C3.ai’s EV-to-sales ratio is over 11x, well above the sector median of 3.3x, indicating a valuation premium of over 250%.

High acquisition costs, intense competition from tech giants, and lack of near-term profitability mean C3.ai’s current valuation appears disconnected from its underlying fundamentals. I simply do not think these numbers are justified.

Is C3.ai stock a buy, according to analysts?

At TipRanks, AI is a Hold based on 2 Buy, 4 Hold, and 3 Sell ratings assigned by analysts over the past 3 months. AI’s average price target is $38.25, suggesting downside potential of 0.78%.

See more AI analyst reviews

Conclusion of C3.ai

There are several reasons why I’m bearish on C3.ai, but its valuation is the central one. The company isn’t expected to become profitable until 2027, and its earnings trajectory doesn’t look particularly attractive, especially compared to its peers. We also operate in an environment that is rapidly becoming more competitive. Tech giants with vast resources are investing heavily in AI, potentially surpassing the capabilities of C3.ai. Considering these factors, I believe the current valuation is unsustainable and this stock poses significant risk for investors.

disclosure