Artificial intelligence may be too fast for state insurance regulators.

The difficulty in trying to create rules for rapidly moving AI amid a slow pace that regulators liked was a major topic of discussion during the Big Data and Artificial Intelligence Working Group meeting on Tuesday.

The group met at the National Association of Insurance Commissions Spring Meeting.

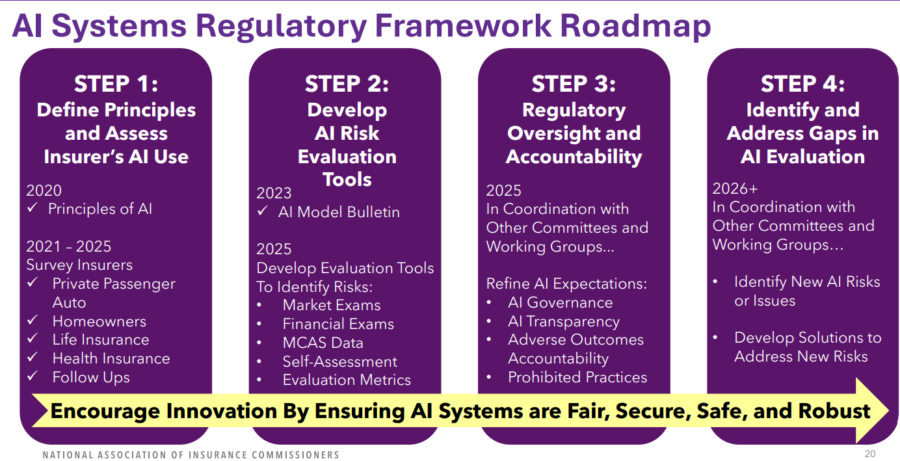

In 2020, NAIC adopted the principles of artificial intelligence and established basic guidelines for the ethical and responsible use of AI in the insurance industry. Three years later, NAIC approved a model report on the use of artificial intelligence systems by insurers.

However, it is not enough for those who follow AI issues.

“Are insurance consumers better informed and protected, especially in this area than in this area (2020)?” asked Peter Kochenberger, visiting professor of law at the Southern University Law Center. “I hope it’s not a rhetorical question, but I think it’s because there’s still a single specific right or guidelines that consumers have.”

Working Group co-chairs, Iowa State Insurance Commissioner Doug Omen and Pennsylvania State Insurance Commissioner Michael Humphries outlined the four-step process along the way.

Humphreys noted that there is a positive dialogue to remind consumers that they have rights under existing insurance coverage. Similarly, 23 states and the District of Columbia employ model bulletins in AI.

But Humphreys also agreed that he had to come sooner rather than slower.

“What I agree with you is that we have to go faster,” he said. “We’re starting to see AI laws in our states, and that can be very different in different states. So when we’re trying to keep up with the argument that there shouldn’t be a federal floor and that there shouldn’t be a federal ceiling, we’d better start something.”

A small number of states do not await the laws of the NAIC model on related areas such as AI and consumer protection, data privacy, and accountability.

In particular, Colorado became the first state to pass a comprehensive law regulating AI. The Colorado AI Act, effective February 1, 2026, requires developers and deployers of AI high-risk systems to use care to protect consumers from known or reasonably foreseeable risks of algorithm identification or bias.

Health insurance companies love AI

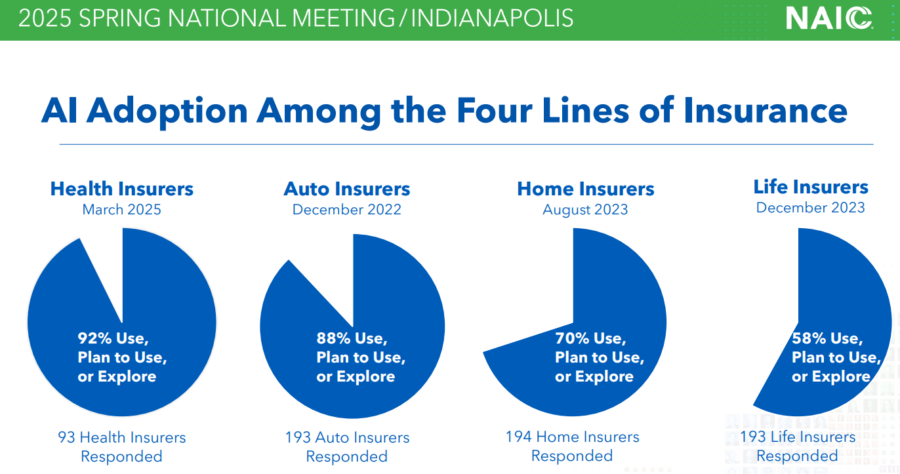

The Working Group shared the latest research data from the health insurance industry. The survey was conducted in 16 states and completed by active insurance companies. Or they held significant market share in one or more participating states.

Humphreys said 93 health insurance companies met the criteria and responded to the survey. Mark the fourth insurance segment surveyed by the working group, with each survey returning greater enthusiasm for AI. 92% of health insurance companies say they will “use, use, or explore” AI use.

Humphreys acknowledged that the length of time to the most recent results during the initial survey certainly skewed numbers.

“I think, as we know, AI development, the development of AI, is moving pretty quickly,” he said.

Humphreys said the group has not fully completed a full report on health insurance companies and AI, but more than 200 pages of reports should be available in April.

Of the participating companies, 83% said they were “active” using AI. Health insurers face many lawsuits over the use of AI to process claims. One such lawsuit covers health and science news following a detailed investigation by STAT. STAT details how UnitedHealth uses computer algorithms to block care for older patients.

According to the statistics report, the internal documents claim that UnitedHealth managers have set goals for clinical employees to maintain patient rehabilitation within 1% of the number of days predicted by the algorithm.

Some obstacles remain in AI

Only 9% of respondents said they were “planning or investigating” the use of AI in their businesses, Humphries said.

“It’s amazing that some companies have not yet used AI, but some of the companies we’re talking about face some obstacles to implementing AI,” he explained.

Brian Bayer, chief actuary of the American Life Insurance Council, said the working group “urged to focus on claims to monitor and promote the implementation of model bulletin, which should include assessments of the effectiveness of bulletin by gathering lessons learned from both the industry and regulatory authorities.”

“This analysis is really necessary before considering which tools are needed, especially the additional requirements.”

Humphreys opposed the final part, saying he would pursue action so that regulators could be deemed necessary.

©copyright 2025 by insurancenewsnet.com Inc. Some of this article will not be reprinted without written consent from Insurancenewsnet.com.