Simply put

Virtual protocols lead the wave of AI agents with real traction, viral frameworks and powerful on-chain momentum. The render powers the visual layer of AI, with the Solana upgrade setting the stage for breakout performance. The next stage in code evolution.

We all know that AI is evolving rapidly. From managing autonomous bot logistics to generative models that create real-time narratives, this technology is no longer a back-end tool, but is reconstructing how humans and machines interact.

But when you integrate it with crypto infrastructure, you get something stronger than a “faster system.” An adaptive self-improvement network, an environment in which values, logic, and behavior evolve in chains.

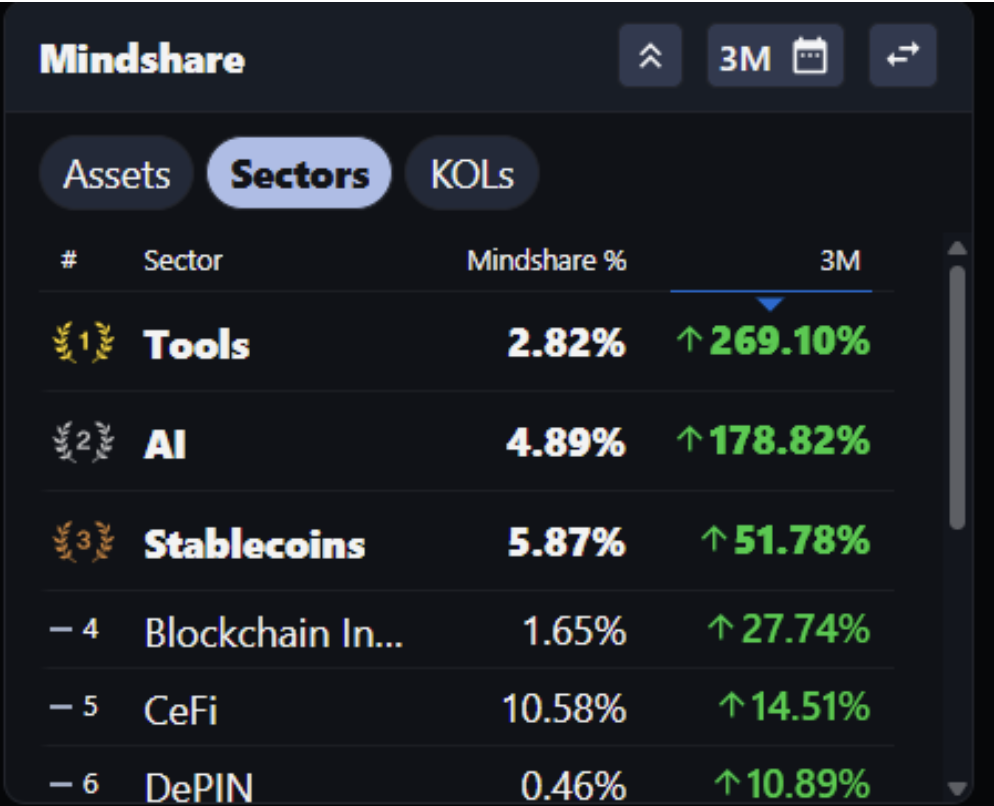

According to Messari, AI Mindshare, which crosses the Crypto space, ranks as the second best performance sector, with an increase of 178% over the past 90 days. But it’s not a general calculation or LLM token that leads to charging. It’s an agent framework that’s up 86%, surpassing all other AI-related sectors.

It’s not just hype – it’s a signal. The market is awakened to the idea that the future of blockchain is not just about executing code. It is to embed autonomous intelligence directly into smart contracts, protocols, and on-chain economies.

This shift – overseeing AI agents thinking, adapting and acting in real time – is where the next wave of crypto innovation is being formed. And the token building for that layer? They’re not just on the trend, they’re defining it.

Virtual Protocol (Virtual): Modular Backbone for AI Agents

The virtual protocol, launched in October 2024, quickly positioned it as the go-to infrastructure for chaining autonomous AI agents. While most AI tokens remain stuck on ideas or closed beta, the virtual is live, processing millions of fees, processing onboarding creators, and scaling the integration of base and Ethereum.

That outstanding innovation? Ribbita (Tibbir) is a stealth launch agent framework that saw a surge in over 8,800% in 2025. Actual Value introduces modular AI personas that can work independently, monetize through use, and evolve within the digital ecosystem. Think of it as the Web3 Work AI App Store.

Meanwhile, Iris, a utility grade agent for Virtual, launched at Ethereum, offers real-time smart contract auditing using social and code signals. It debuted without team allocation, oversubscribed 1,500%, making it one of the most transparent launches in the AI token space.

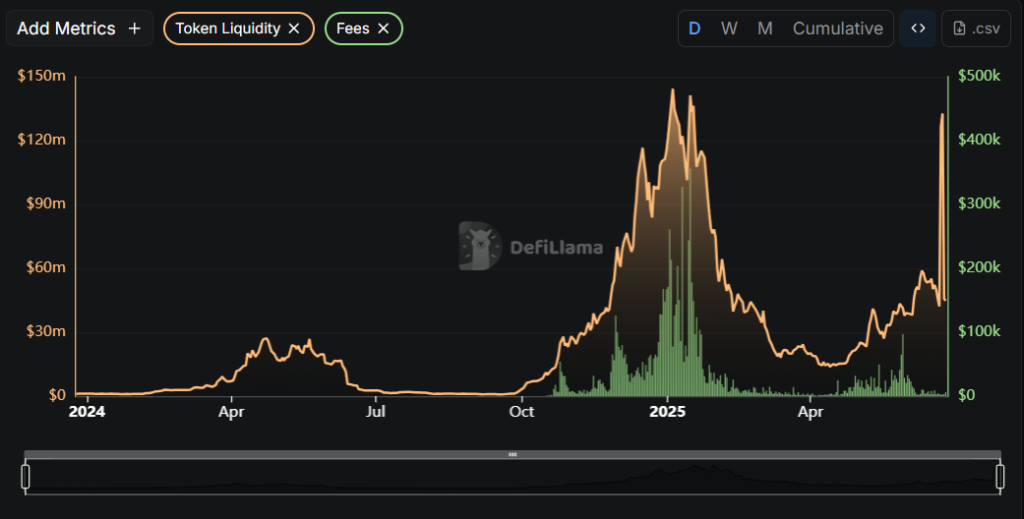

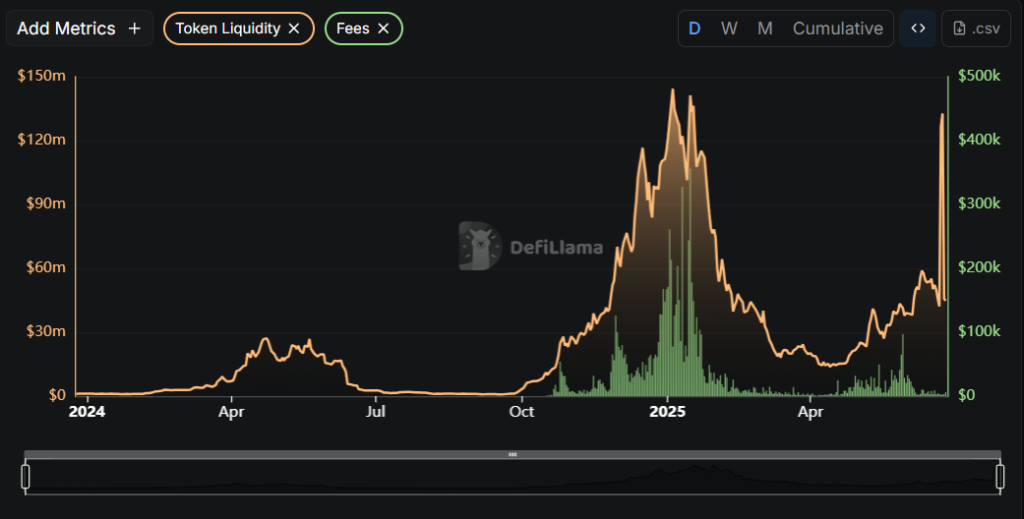

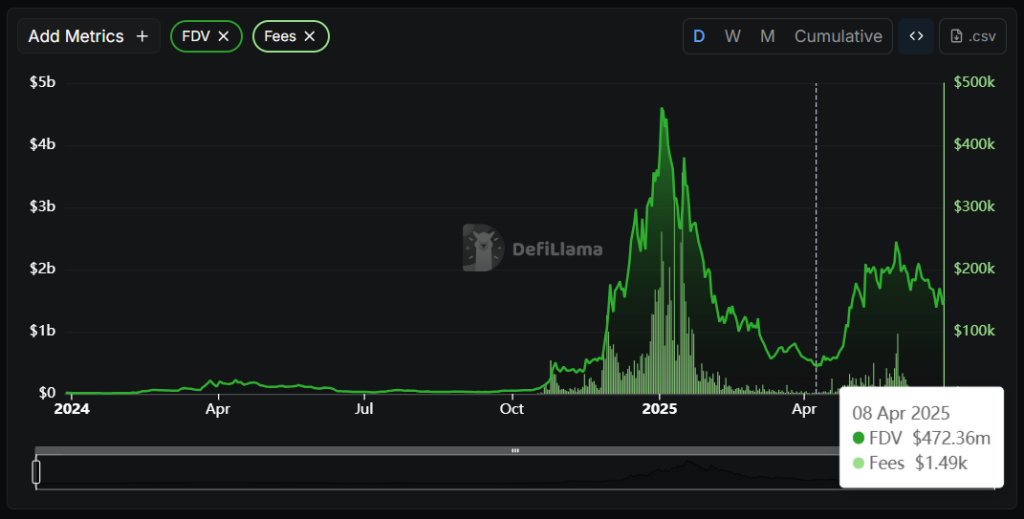

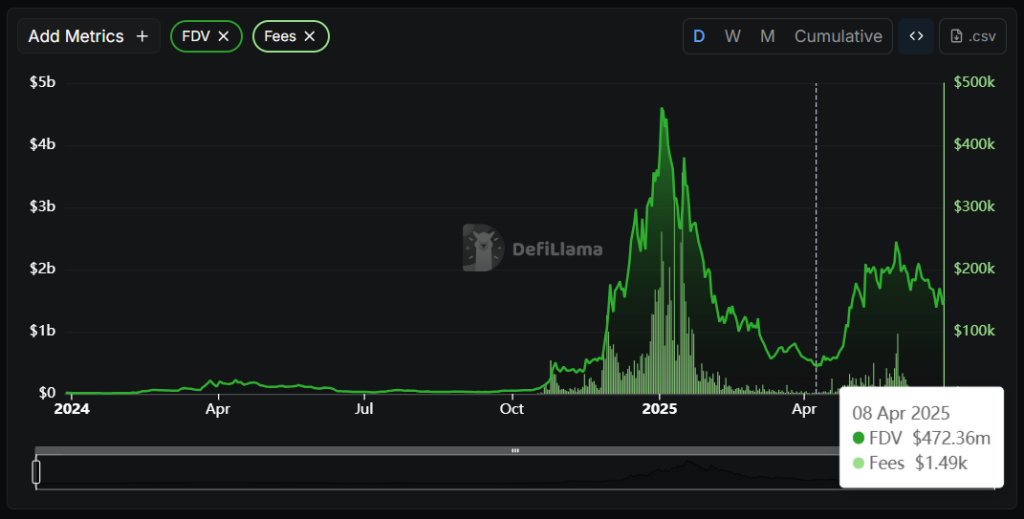

On-chain data supports the momentum behind virtual protocols, with the project continuing to exceed $8.3 million in cumulative protocol fees and a robust $5.6 million in annual revenues.

Liquidity has skyrocketed above $140 million, but daily trading volumes consistently exceed $250 million, placing it in the most actively involved AI tokens on the market.

From Technical View, the token currently holds its 200-day EMA at nearly $1.39. This is a historically strong long-term support.

A clean flip of $1.70 could ignite the upward momentum towards $2.80-3.00 in the third quarter of 2025, but a short-term retest could be $1.10 for a breakdown below $1.39.

However, its utility, volume, and developer traction suggest that virtual is not a trend, not an infrastructure.

Render Network (RNDR): Powers the surface of AI

Let’s face it. AI agents are smarter, faster, and more autonomous. But for them to truly connect with people, they need more than just intelligence. They need to have a presence.

They need to be viewed, animated and responded in real time. That’s where the rendering network intervenes. It is a GPU backbone that powers the visual aspects of AI.

Rendering doesn’t build an AI brain. Build a canvas where those brains will come back to life. The distributed network of NVIDIA GPU providers enables everything from photorealistic 3D rendering to real-time animation and generated visuals.

As AI agents move towards realistic avatars and digital humans, rendering is infrastructure, visually possible, efficient and on-chain.

Let’s consider what’s going on in China. In the current Viral livestream, two AI avatars sold over $7.6 million in product to 13 million viewers in just six hours.

Neither host was authentic. Instead, these AI presenters are equipped with high fidelity animation, real-time response models, and emotional simulations.

This was not science fiction. This is a retail experience run entirely by synthetic persona, reducing costs by 80% while increasing sales by 62%.

The platform’s momentum never stopped. In 2025, rendering moved from Ethereum to Solana. This move significantly improved performance and reduced costs.

This allows for faster transactions and large-scale real-time rendering. This is suitable for applications such as avatar interactions and microtransactions between agents and users.

With the launch of Render Compute (RNP-019), it has expanded beyond visuals to general AI calculations, pushing up the boundaries that decentralized GPU networks can support.

Technical outlook

Render (RNDR) is now integrated just above the key $4.00-4.20$4.20 support zone, closely aligned with the historically reliable accumulation level of 100 days. Despite recent broader market weaknesses, the zone has consistently attracted medium term buyers, particularly following the protocol’s transition to Solana.

Immediate resistance is $5.80. A confirmed breakout above this level could activate bullish legs to $7.50, with an even greater increase potential extended to $8.80 as volume and broader emotions continue to improve.

Momentum Indicators supports this setup. The RSI is neutral at around 52, but shows signs of bullish uptrends. Meanwhile, MACD has just crossed the signal line, indicating a potential change in the short-term momentum that favors the Bulls towards the third quarter of 2025.

In particular, RENDER’s expanding utility adds weight to bullish setups, including general AI calculations via RNP-019. It could serve as a spark for major gatherings if the project introduces new integration or institutional partnerships, particularly post-Solana transitions.

On the downside, if you fall below $4.00, you can retest the previous accumulation zone of RNDR, which is the $3.30-3.50 range. However, current technical indicators are wasting bullishness, supported by the growing demand for strong foundations and decentralized GPU power.

Artificial Supervisory Alliance (ASI): From vision to chain intelligence execution

Born from the unification of Fetch.ai, singularitynet and Ocean Protocol, the artificial super intelligence alliance (ASI) is not just an AI story, but a convergence of three of the most researched AI initiatives in Web3.

Once the token merger is finally complete, ASIs will now serve as a unified economic layer driving decentralized AI agents, data markets, and machine learning infrastructure.

However, it is the early development of ASI ‑ 1 Mini in 2025 that will promote ASI beyond Tocononomics. This is a compact web three native LLM designed for real-time agent communications. Unlike traditional large language models that require expensive hardware, the ASI‑1 Mini runs on two GPUs, allowing for large, efficient, distributed intelligence.

This breakthrough significantly reduces the barriers for developers to deploy autonomous agents across various blockchains, making the ASI Tech stack not only futuristic, but also readily accessible.

Supporting this technical momentum is the $50 million Token Buyback initiative by the Fetch.ai Foundation. This is not just a price stabilization measure, it is a bold signal of internal trust and long-term commitment to the ASI roadmap.

In an environment where many projects live and die with emotions, this financial intensification makes ASI stand out as serious and sustainable.

From a chart perspective, ASI (FetUSD) currently shows early signs of recovery. The token is about to collect the 50-day EMA at nearly $0.69.

A confirmed flip above this zone could pave the way to $0.85-$1.00, especially when momentum coincides with rotations in the wider AI sector.

However, strong horizontal support at $0.56 remains important. Violations below this level can negate bullish momentum in the short term.

Technology aside, the RSI currently reads 45.8. In the neutral zone, it is stored in water, but is carved high. Meanwhile, the MACD histogram shows early signs of bullish crossovers, suggesting a positive momentum increase.

The story is no longer theoretical. As AI frameworks begin to merge with actual blockchain deployments, new layers of infrastructure are emerging. Not only is intelligence processed off-chain, it also lives, evolves and directly monetizes within a distributed environment.

Virtual protocols are turning modular agents into plug and play ecosystems. The Render Network offers visual bodies and real-time interactivity for these agents. ASIs push limits up with a large, efficient, on-chain language model and a unified economic class across data, logic and computation.

Each of these projects not only react to trends, but also architecturally tests the foundations of intelligent blockchain. As we head deeper into Q3 2025 and beyond, AI agents will move from story hype to daily utilities. Shifting token building? They don’t just do it. They define the next dominant cycle of crypto evolution.

In a world where smart contracts are now learning and avatars sell humans, these AI infrastructure coins are not an option. These are inevitable.