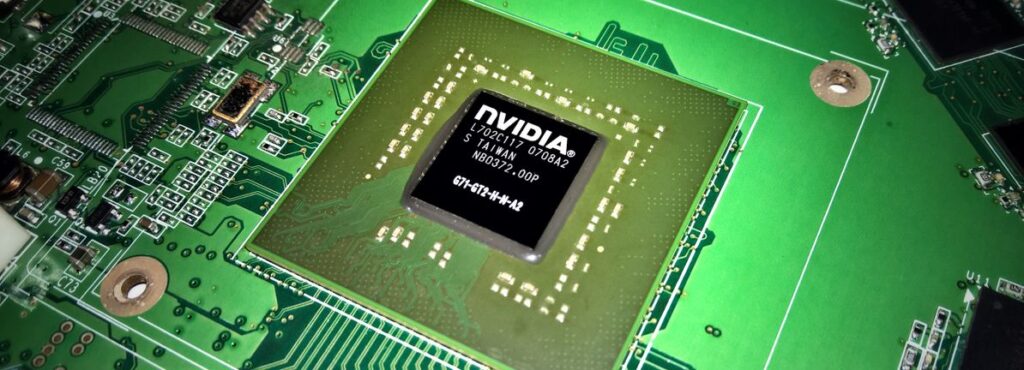

Nvidia recently collaborated with Trend Micro to enhance its security delivery through integration with NVIDIA’s accelerated computing and AI enterprise software. The partnership will take place alongside other enterprise initiatives during periods of volatile tech stocks. Nvidia’s share price has risen 15% over the past week due to previous market trends, but it is notable that the broader market is similarly buoyant, with a 7% increase. As the market faces future economic data releases and key revenue reports, Nvidia’s strategic moves, including its partnership with Trend Micro, provided additional resilience amid fluctuations in technology sector performance.

We have found two possible red flags for nvidia you should know, and one of them should not be ignored.

Find companies with promising cash flow potential, but below fair value.

NVIDIA’s collaboration with Trend Micro aims to enhance security delivery by integrating with NVIDIA’s accelerated computing and AI enterprise software. This development will help Nvidia drive into AI-driven markets and enhance its appeal in the data center and automotive sector. Over the past five years, Nvidia’s total shareholder profit, including stock valuations and dividends, has been extremely high at 1,430%. This performance highlights its growth trajectory compared to the broader semiconductor sector, which has experienced more modest profits over the past year.

The partnership with Trend Micro could enhance Nvidia’s revenue and revenue outlook by expanding its footprint with AI and computing services. Analysts forecast revenue and revenue growth rates that reflect this possibility, with forecasts showing a continuous upward trend. However, issues such as regulatory issues and component costs can affect margins. The current stock price is USD 98.89, with a consensus analyst price target of a substantial discount compared to USD 164.74, indicating potential opportunities for investors if future growth estimates are met. Such price transfers suggest Nvidia’s optimism about strategic partnerships and product innovation.

Looking at the latest valuation report, Nvidia’s stock price may be too pessimistic.

This article simply by Wall Street is inherently common. We provide commentary based on historical data and analyst forecasts, and use impartial methodologies, and our articles are not intended for financial advice. It is not a recommendation to buy or sell stocks and does not take into account your goals or financial situation. We aim to deliver long-term intensive analysis driven by basic data. Please note that the analysis may not take into account the latest price-sensitive company announcements and qualitative material. Simply put, the Wall ST has no position in the stock mentioned.

The story continues