Nvidia has come under pressure in recent weeks amid an AI trade review, but one major bank says investors don’t see much reason to worry about the chip king.

Nvidia’s stock price fell 9% last month. Even blockbuster third-quarter results failed to generate new excitement for the company and the broader AI sector. Pressure is mounting as big-name investors such as Peter Thiel and SoftBank are dumping shares.

But Morgan Stanley’s Joseph Moore pushed back on that optimism this week, raising his price target on the bank’s stock to $250 from $235 on Monday. The new target is one of the highest on Wall Street and would represent an increase of nearly 40% from current levels.

Moore said he believes the threat to AI leaders’ market share, particularly in Asian markets, is overstated.

Speculation that NVIDIA’s dominance in the AI market could be threatened is not new. Ever since the launch of ChatGPT in November 2022 catapulted the AI leader to the top of the technology space, investors have wondered how long the company could maintain its position as the top manufacturer of AI hardware.

However, despite China’s prioritization of building its own semiconductor supply chain, Morgan Stanley does not believe other chipmakers pose a significant threat to Nvidia. Analysts recently visited Asia and shared their views on why NVIDIA doesn’t need to worry about competition from the East.

“Although Chinese AI solutions are receiving significant attention, we believe they are very limited on multiple levels, including cluster size and scale-out technology, and Chinese software still prefers access to Western solutions,” the analysts said in a note on Monday.

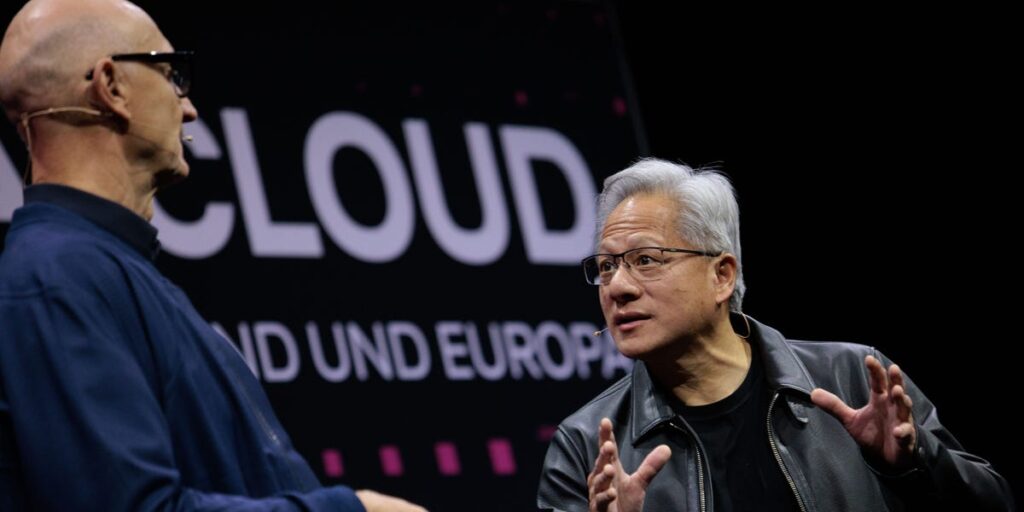

Moore also said the team adjusted the ambitious $500 billion estimate for chip revenue that CEO Jensen Huang gave at Nvidia’s GTC event in October.

“Having met with several stakeholders both in Asia and the U.S., we are comfortable increasing our estimates to get revenue to that level.”

Analysts raised their price targets for Nvidia and fellow chipmaker Broadcom, but said they still view Nvidia as the clear winner in the sector.

“While we model that AVGO and AMD will grow AI processor revenue slightly faster than NVDA in 2026, this only reflects supply chain constraints, primarily a $205 billion run-rate revenue stream. All major products will be supply constrained through 2026,” the note states.

Analysts believe that even as competition in the AI chip market increases, Nvidia will still maintain the best performance-to-cost ratio and have access to a wider range of AI applications and workloads than its competitors.