In a recently released blueprint, Info-Tech Research Group provides insurers with a comprehensive framework to address the growing challenges of data privacy in the age of AI. Among these resources, the global research and advisory firm offers AI training, We advocate strong data governance and proactive risk management.

Toronto, December 13, 2024 /PRNewswire/ – As AI adoption continues to accelerate, the insurance industry is under pressure to protect personally identifiable information (PII) from advanced data privacy risks. Info-Tech Research Group, a global research and advisory firm, reveals in a newly published industry resource that traditional system protection measures and outdated legacy systems cannot address the complexities of modern AI-driven processes. It explains that it has been found to be inadequate, leaving insurers exposed to regulatory and technological vulnerabilities. To help insurers address these pressing challenges, the Info-Tech Research Group’s blueprint, “Securing Data When Introducing AI into Insurance Systems,” is a blueprint for integrating privacy-preserving AI solutions. provides a strategic framework for The company’s resources include research insights and tools that enable IT leaders in the insurance industry to strengthen compliance, reduce risk, and protect PII while maintaining system performance.

“Insurance companies handle vast amounts of data, from health records to financial history, that feed into AI systems that promise accuracy and efficiency, but also privacy concerns,” Info-Tech Research Group says Arzoo Wadhvaniya, research analyst. “A single breach can compromise the personal information of thousands of customers, causing severe reputational and financial damage. It is important not only what AI can do, but also whether it is safe and secure. It’s about ensuring that it’s done ethically.”

Info-Tech explains in its blueprint that traditional data protection methods in the insurance industry are becoming increasingly ineffective as legacy systems often lack the flexibility to meet modern demands. Masu. The company’s findings suggest that employees unfamiliar with integrated AI technologies can be confused when assessing risk and determining appropriate applications. Complex regulatory requirements that may not align with AI-driven processes further increase compliance challenges. To address these issues, Info-Tech recommends AI training programs that help employees understand the risks involved and foster a culture of security and compliance.

“Regulatory frameworks require strict compliance, but AI introduces complexities that make this difficult. Insurers need to ensure that AI respects customer consent, limits data usage, and We need to ensure that we reduce stigma; otherwise there can be costly consequences, both in terms of fines and loss of trust.” Wadvaniya.

Info-Tech’s new resource provides insurance industry IT leaders with actionable strategies to address significant risks associated with generative AI. The company emphasizes the importance of identifying insurance-specific risks and adopting a continuous improvement approach supported by metrics and risk-based strategies aligned with a privacy framework tailored to an organization’s needs.

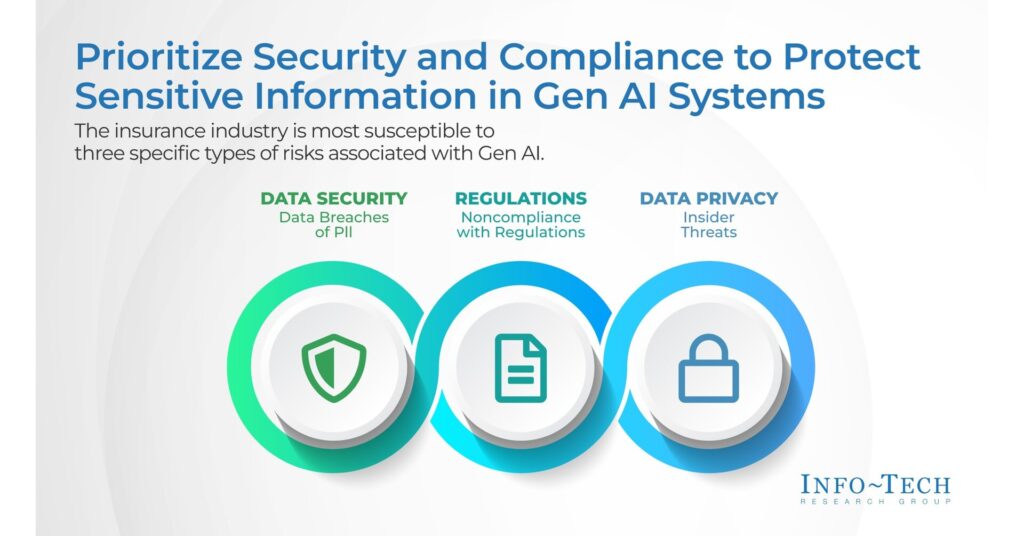

The study highlights three key risks associated with generative AI.

PII data breaches: AI systems within insurance companies process vast amounts of sensitive customer data, including health records, financial details, and personal identifiers. If not properly secured, these systems can become targets for cyber-attacks and lead to unauthorized access to sensitive information. Regulatory Violations: Privacy regulations such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA) impose strict requirements on how customer data is collected, processed, and stored. AI systems in the insurance industry often require large datasets to function effectively and, if not properly designed and monitored, can unintentionally violate these regulations. there is. Insider threat: Employees or third-party contractors granted access to AI systems or sensitive customer data can intentionally or inadvertently misuse that privilege. This can lead to data theft, manipulation of critical AI models, and tampering with billing and pricing algorithms.

The company advises the industry to take a proactive stance in implementing robust data governance practices, ensuring transparency and fostering customer confidence in the responsible use of AI. Leveraging insights from this blueprint, insurers can effectively address growing data privacy challenges while deploying advanced AI technologies in underwriting, claims processing, and customer engagement.

For exclusive and timely commentary from IT strategy expert Arzoo Wadhvaniya, and access to the complete data protection blueprint for implementing AI in insurance systems, please contact us below. (email protected).

About Information Technology Research Group

Info-Tech Research Group is one of the world’s leading research and advisory firms, serving more than 30,000 IT and HR professionals. The company produces unbiased, relevant research and provides advisory services to help leaders make strategic, timely, and informed decisions. For nearly 30 years, Info-Tech has been working closely with teams to provide them with everything they need, from practical tools to analyst guidance, ensuring measurable results for their organizations. has been provided to.

For more information about Info-Tech’s divisions, visit McLean & Company for HR research and advisory services and SoftwareReviews for software purchasing insights.

Media professionals can sign up for unlimited access to research and hundreds of industry analysts across IT, HR, and software through the company’s Media Insiders program. For access please contact us (email protected).

For information and access to the latest research on Info-Tech Research Group, visit infotech.com and connect via LinkedIn and X.

SOURCE Information Technology Research Group