Fraudulent claims are increasing every year, driving up premiums for honest customers and placing operational and financial burdens on insurance companies. Businesses need to address this growing problem. However, detecting and preventing fraud is difficult without modern tools.

Fraudsters are becoming increasingly sophisticated and utilize techniques to circumvent traditional systems. One solution is to invest in innovative technologies such as artificial intelligence (AI). Many companies are already integrating AI to fight fraud and help insurance companies prevent them in a variety of ways.

Business Insurance Fraud Overview

Insurance fraud is a growing challenge for businesses and insurance companies. Recent data reveals the scale of the problem, with 1 in 30 people in breach of their bill. In 2023 alone, there were 115.3 cases of insurance fraud worldwide. The impact of such activities is far-reaching in financial losses and operational inefficiencies.

For example, processing suspected manufacturing claims takes three times as long, leading to delays and increased administrative costs. Additionally, 68% of industry experts expect fraud to increase over the next five years, making prevention more important than ever.

The main factor driving insurance fraud is the sophistication of the methods used.

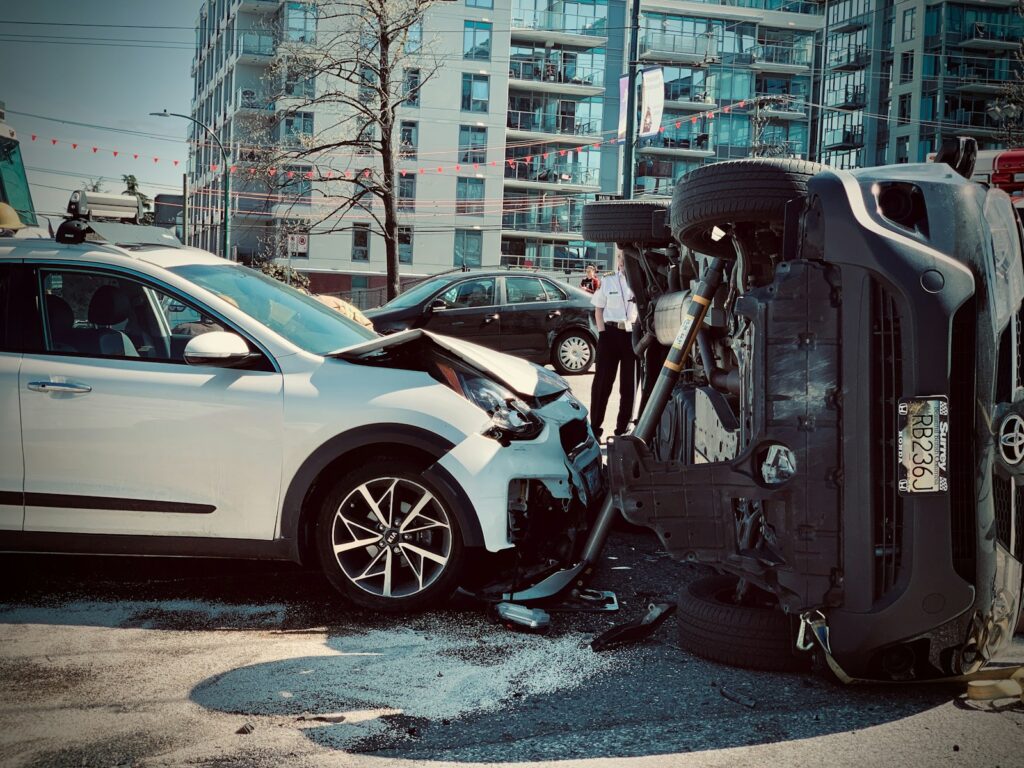

Advances in technology have led to more complex schemes, including deepfakes and synthetic identities, social engineering tactics, and image enhancement software. Each technique makes fraud more difficult to detect. As a result, insurance companies and businesses must employ sophisticated tools to combat these schemes.

How AI can help with business insurance fraud

Like many other industries, insurance is making greater use of AI. Especially as insurance fraud becomes increasingly complex. Artificial intelligence has become a powerful tool in this fight, providing innovative solutions to more effectively detect and respond to fraudulent activity.

42% of insurers have already invested in generative AI tools, while 57% plan to do so in the near future as they protect businesses on a larger scale. Here’s how insurance companies are using AI tools to implement safety and efficiency.

1. Facilitates real-time fraud detection

AI can detect fraud in real-time by analyzing vast amounts of data for patterns that are impossible for humans to spot quickly. We then utilize advanced algorithms to monitor every claim that passes through us.

Once submitted, this technology can flag suspicious activity, such as inconsistent documentation, unusual billing amounts, or repeated charges from the same person or entity. This instant analysis allows insurance companies to act quickly, reducing time spent on investments and preventing payouts.

2. Identify anomalies with machine learning

Machine learning is great at detecting anomalies in insurance claims by analyzing datasets and understanding patterns over time. While traditional methods rely on static rules, machine learning algorithms use new data to improve over time. This allows the technology to detect irregularities in fraud and indicate fraud signals.

For example, these systems can compare complaint details with historical data to discover discrepancies, such as claims that deviate from typical patterns. Continuously refining models will make machine learning tools more effective, allowing insurers to focus on high-risk claims while streamlining the legitimate ones.

3. Authenticate documents using computer vision

Computer vision is important in validating insurance claim documents. By analyzing photos, videos, and scanned documents, its algorithms can detect signs of tampering or manipulation. For example, you can spot inconsistencies in lighting or pixel patterns that suggest an edited image.

Additionally, computer vision tools can cross-reference documents with databases to verify legitimacy, such as checking license plates or property ownership records. This advancement accelerates verification and improves efficiency and confidence in the claims process.

4. Monitor behavioral patterns with predictive analytics

AI-powered predictive analytics can also detect irregularities in user activity. Analyze user behavior, such as login frequency, geographic location, and changes in complaint filing patterns. These insights allow insurers to continue investigating potential fraud before it escalates.

5. Enhance customer validation with natural language processing

Natural Language Processing (NLP) is a branch of AI that focuses on understanding and analyzing human language. In the insurance industry, companies can use it to enhance their customer verification processes by identifying inconsistencies or red flags in written or verbal communications.

NLP algorithms can accomplish this by analyzing the language used in claim descriptions, emails, and phone transcripts to detect signs of deception, such as contradictory statements. Additionally, NLP can cross-check customer information with other records to ensure accuracy. By automating these checks, NLP reduces manual efforts and ensures speedy processing of legitimate claims.

6. Predict emerging fraud trends

AI’s ability to analyze historical data and real-time patterns allows the system to notice changes in fraud schemes before they become widespread. For example, machine learning models can detect an uptick in claims with similar fraud characteristics.

Additionally, AI can assess external factors such as economic conditions and local events to predict fraud spikes in vulnerable areas. This capability allows insurers to stay ahead of emerging tactics and address new schemes before they cause damage.

Use AI to prevent fraud

As insurance fraud increases, so does the need for AI to prevent it. This innovation has become invaluable for a variety of reasons. Keeping insurance companies one step ahead of new tactics while handling business and saving businesses considerable time and money.

As deception continues to evolve, staying proactive with the latest AI prevention strategies is essential. Businesses can benefit from AI solutions. Because investing in them ensures long-term resilience and success in the sector.

Zac Amos is a feature editor at Rehack, covering Business Tech, HR, and Cybersecurity. He is also a regular contributor to Allbusiness, TalentCulture, and VentureBeat. To learn more about his work, follow him on Twitter or LinkedIn.

Tglobal Insider publishes contributions related to entrepreneurship and innovation. You may submit your own original or published contributions, which will be subject to editorial discretion.

Need to launch a startup podcast?