Claman Countdown panelists Scott Bauer and Jay Woods unravel the company’s earnings.

Nvidia released an earnings report on Wednesday, predicting fourth-quarter revenue to beat Wall Street expectations, but the numbers were one of the highest the artificial intelligence (AI) giant has amassed during its historic rise. Investors balked after the results fell short of expectations.

According to data compiled by LSEG, NVIDIA expects fourth-quarter sales of $37.5 billion, compared to the average analyst estimate of $37.09 billion, plus or minus 2%.

The company’s shares closed down 0.76% in Wednesday trading. In after-hours trading, the stock fell further, dropping 3.4% at one point, but the decline narrowed to about 1.9%.

“The era of AI is in full swing, driving the global transition to Nvidia computing,” said Nvidia Founder and CEO Jensen Huang. “As foundational model makers scale pre-training, post-training, and inference, the demand for Hopper and the expectations for Blackwell will be incredibly high at full capacity.”

Top ETFS of 2024 are tied to one stock: NVIDIA

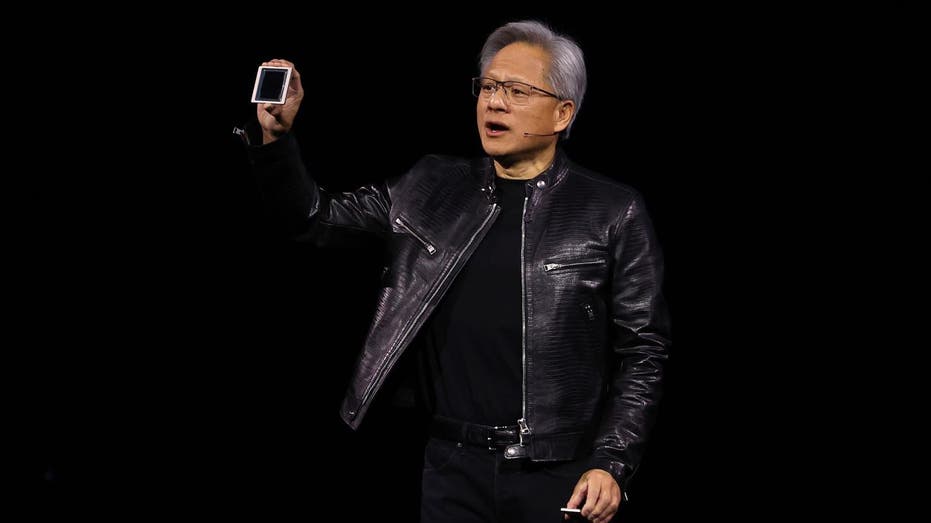

Nvidia issued an optimistic forecast for fourth-quarter revenue, beating analysts’ expectations. (David Paul Morris/Bloomberg via Getty Images/Getty Images)

“AI is transforming every industry, company, and country. Companies are adopting agent AI to revolutionize workflows. Breakthroughs in physical AI are driving a surge in investment in industrial robots. And countries are waking up to the importance of developing their own AI and infrastructure,” Huang said.

Ticker Security Last Change Percent Change NVDA NVIDIA CORP. 145.89 -1.12 -0.76%

Nvidia reported that its third quarter 2025 revenue increased 17% sequentially and 94% year-over-year. Operating expenses increased 9% sequentially and 110% year over year.

Net income for the quarter was more than $19.3 billion, up 16% from the previous quarter and 109% from this time last year.

How NVIDIA went from Denny’s to the king chip maker with a market cap of $2.3 billion

Nvidia CEO Jensen Huang showed off Blackwell chips at a conference in March. (Justin Sullivan/Getty Images/Getty Images)

Nvidia set a company record in the third quarter with quarterly revenue of $35.1 billion, including $30.8 billion in revenue from its important data center division.

Nvidia’s data center sales are driven by companies spending on AI chips amid data center expansion aimed at enabling them to meet the complex processing needs of generative AI programs .

Next-generation Blackwell chips have been the focus of some concern among investors following reports that design flaws are causing advanced chips to overheat, but NVIDIA The company said it has corrected the issue and worked with the manufacturer, TSMC, to make improvements.

CLICK HERE TO GET FOX BUSINESS ON THE GO

Nvidia stock is up about 202% so far in 2024 and 189% over the past year amid the generative AI boom.

Reuters contributed to this report.